Change Your Monetary Future with Professional Tips on Credit Repair

Change Your Monetary Future with Professional Tips on Credit Repair

Blog Article

A Comprehensive Guide to Exactly How Credit Score Repair Service Can Change Your Credit Rating

Understanding the intricacies of credit history repair work is important for any person looking for to improve their economic standing - Credit Repair. By dealing with issues such as repayment background and credit report application, individuals can take proactive actions towards improving their credit rating. The process is often laden with mistaken beliefs and possible pitfalls that can prevent development. This guide will certainly brighten the essential strategies and considerations essential for successful credit scores fixing, ultimately disclosing just how these efforts can bring about more positive financial opportunities. What stays to be checked out are the particular actions that can establish one on the path to a more durable credit profile.

Understanding Credit Rating

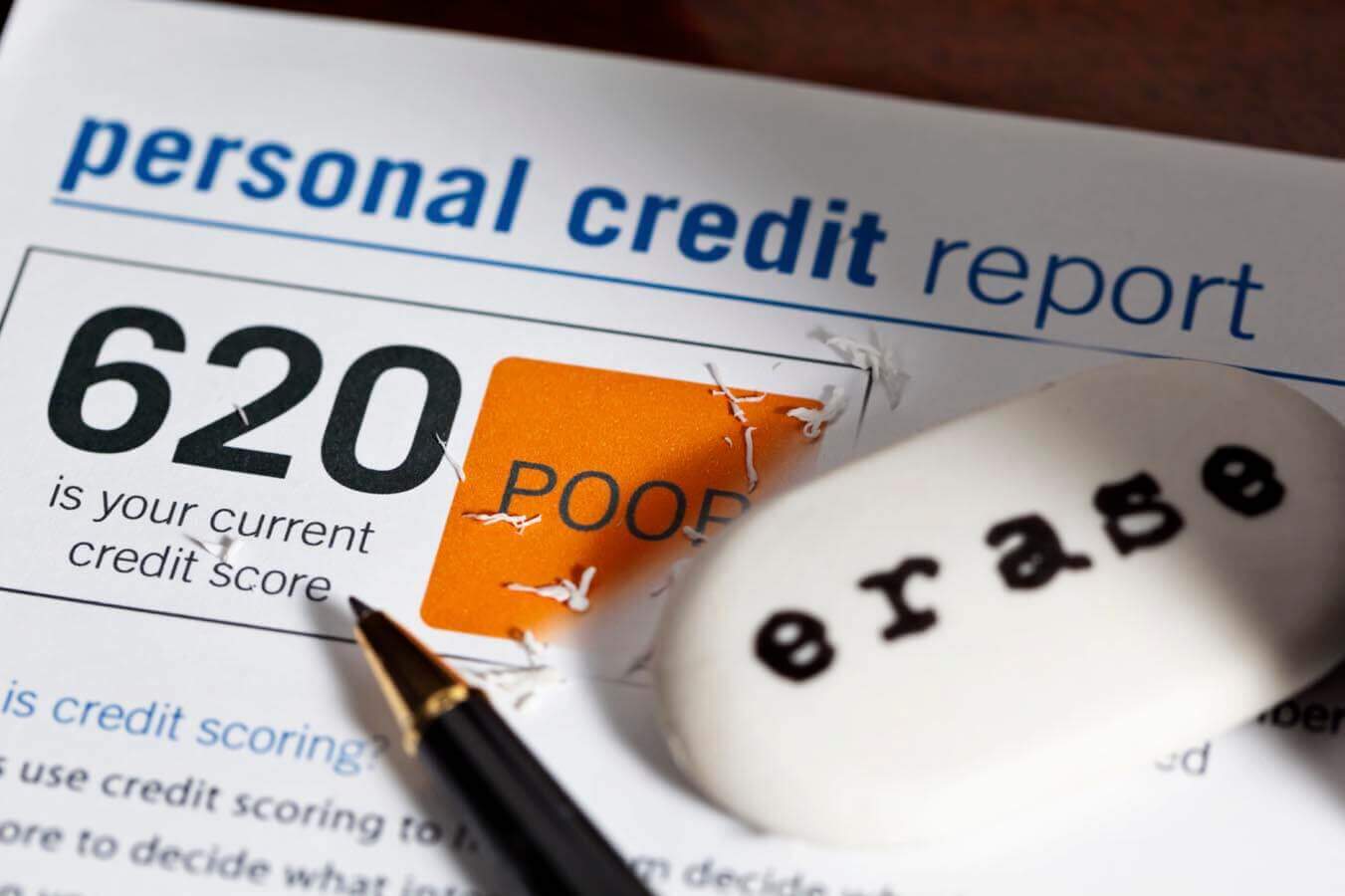

Comprehending credit history is necessary for any person looking for to enhance their monetary health and accessibility better loaning options. A credit report is a numerical representation of a person's creditworthiness, generally ranging from 300 to 850. This rating is produced based on the details consisted of in an individual's credit history record, which includes their credit rating background, arrearages, payment background, and sorts of charge account.

Lenders use credit score scores to assess the risk linked with offering cash or prolonging debt. Greater scores show lower danger, commonly leading to much more beneficial lending terms, such as reduced passion prices and higher credit report limitations. Conversely, lower credit rating can cause greater passion rates or rejection of credit rating completely.

A number of elements affect credit rating, consisting of payment background, which makes up approximately 35% of ball game, followed by credit score usage (30%), size of credit report (15%), kinds of debt in usage (10%), and brand-new debt questions (10%) Comprehending these aspects can empower individuals to take workable steps to improve their ratings, ultimately boosting their financial possibilities and security. Credit Repair.

Common Credit Scores Issues

Lots of individuals deal with typical credit history issues that can hinder their economic development and impact their credit rating. One common problem is late settlements, which can significantly damage credit score ratings. Also a single late repayment can stay on a credit report for several years, influencing future loaning possibility.

Identity theft is another serious worry, potentially leading to deceitful accounts showing up on one's credit score record. Dealing with these usual debt concerns is important to enhancing monetary wellness and developing a solid credit score account.

The Credit Repair Work Refine

Although credit fixing can appear overwhelming, it is an organized procedure that people can undertake to improve their credit report and rectify inaccuracies on their credit reports. The initial step involves acquiring a duplicate of your credit scores report from the 3 significant credit bureaus: Experian, TransUnion, and Equifax. Evaluation these reports carefully for disparities or mistakes, such as incorrect account information or out-of-date information.

When mistakes are identified, the next step is to contest these mistakes. This can be done by speaking to the credit bureaus directly, offering documentation that sustains your claim. The bureaus are called for to investigate disagreements within 1 month.

Preserving a constant repayment history and taking care of credit scores use is also important during this process. Checking your credit regularly makes certain continuous accuracy and assists track renovations over time, reinforcing the effectiveness of your credit score repair efforts. Credit Repair.

Benefits of Credit History Repair Service

The advantages of credit report repair prolong much past just improving one's credit history; they can substantially affect economic security and chances. By dealing with errors and adverse items on a credit history report, people can enhance their creditworthiness, making them extra attractive to lenders and banks. This enhancement commonly causes better rates of interest on car loans, reduced premiums for insurance coverage, and increased possibilities of approval for bank card and mortgages.

In addition, debt repair service can facilitate access to essential services that require a credit report check, such as renting a home or acquiring an utility service. With a healthier debt profile, people might experience raised self-confidence in their monetary choices, enabling them to make larger purchases or financial investments that were formerly out of reach.

Along with tangible monetary advantages, site web credit rating repair service cultivates a feeling of empowerment. Individuals take control of their financial future by actively managing their credit history, bring about even more enlightened options and higher financial literacy. Generally, the advantages of credit score repair add to a much more secure financial landscape, eventually promoting long-term financial development and personal success.

Choosing a Credit Rating Repair Service

Choosing a debt fixing service calls for mindful consideration to guarantee that people get the assistance they need to enhance their monetary standing. Begin by investigating possible companies, concentrating on those with positive client testimonials and a tried and tested record of success. Openness is essential; a credible service should plainly detail their charges, procedures, and timelines in advance.

Next, verify that the credit scores repair work solution adhere to the Debt Repair Work Organizations Act (CROA) This government regulation secures customers from misleading practices and sets guidelines for credit rating repair solutions. Prevent firms that make unrealistic promises, such as guaranteeing a specific score increase or asserting they can eliminate all unfavorable things from your report.

Additionally, consider the level of consumer assistance offered. A good credit history fixing solution YOURURL.com need to give personalized aid, allowing you to ask concerns and obtain prompt updates on your development. Search for solutions that provide a comprehensive analysis of your credit rating record and develop a personalized approach customized to your specific situation.

Eventually, selecting the best credit rating repair solution can bring about substantial enhancements in your credit report, empowering you to take control of your monetary future.

Conclusion

To conclude, efficient credit repair techniques can substantially improve credit score ratings by attending to common concerns such as late repayments and mistakes. A thorough understanding of credit history factors, integrated with the engagement of reliable debt repair service services, promotes the arrangement of adverse products and continuous development surveillance. Inevitably, the effective renovation of credit report not only brings about better lending terms but likewise fosters greater economic chances and stability, highlighting the importance of aggressive credit report management.

By dealing with issues such as repayment background and credit history utilization, people can take aggressive actions towards improving their credit report ratings.Lenders utilize debt scores to analyze the danger associated with lending cash or prolonging credit.One more regular problem is high credit use, specified as the proportion of present credit scores card equilibriums to overall offered credit report.Although credit report repair service can appear challenging, it is a systematic process that people can undertake to boost their credit history scores and rectify inaccuracies on their debt records.Next, verify that the debt repair work service complies with the Credit rating Fixing Organizations Act (CROA)

Report this page